Budgeting Like a Pro: Your Path to Financial Success

Budgeting is often seen as a daunting task for many people, but with the right mindset and techniques, it can be a powerful tool on your path to financial success. Mastering budgets is not just about restricting your spending, but rather about understanding your financial goals and making conscious decisions to achieve them.

One key aspect of budgeting like a pro is setting clear and achievable financial goals. Whether you want to save for a vacation, pay off debt, or invest in your future, having specific goals in mind will help you stay motivated and focused on your budgeting journey. By breaking down your goals into smaller, manageable steps, you can track your progress and celebrate your achievements along the way.

Another important aspect of mastering budgets is creating a detailed budget plan. This involves tracking your income and expenses, identifying areas where you can cut back or save money, and setting aside funds for emergencies and unexpected expenses. By creating a realistic budget plan that aligns with your financial goals, you can take control of your finances and make informed decisions about your spending habits.

Budgeting like a pro also involves being mindful of your spending habits and making conscious choices about where your money goes. This means distinguishing between needs and wants, prioritizing your expenses, and avoiding unnecessary impulse purchases. By being mindful of your spending habits, you can make smarter financial decisions and avoid falling into debt or overspending.

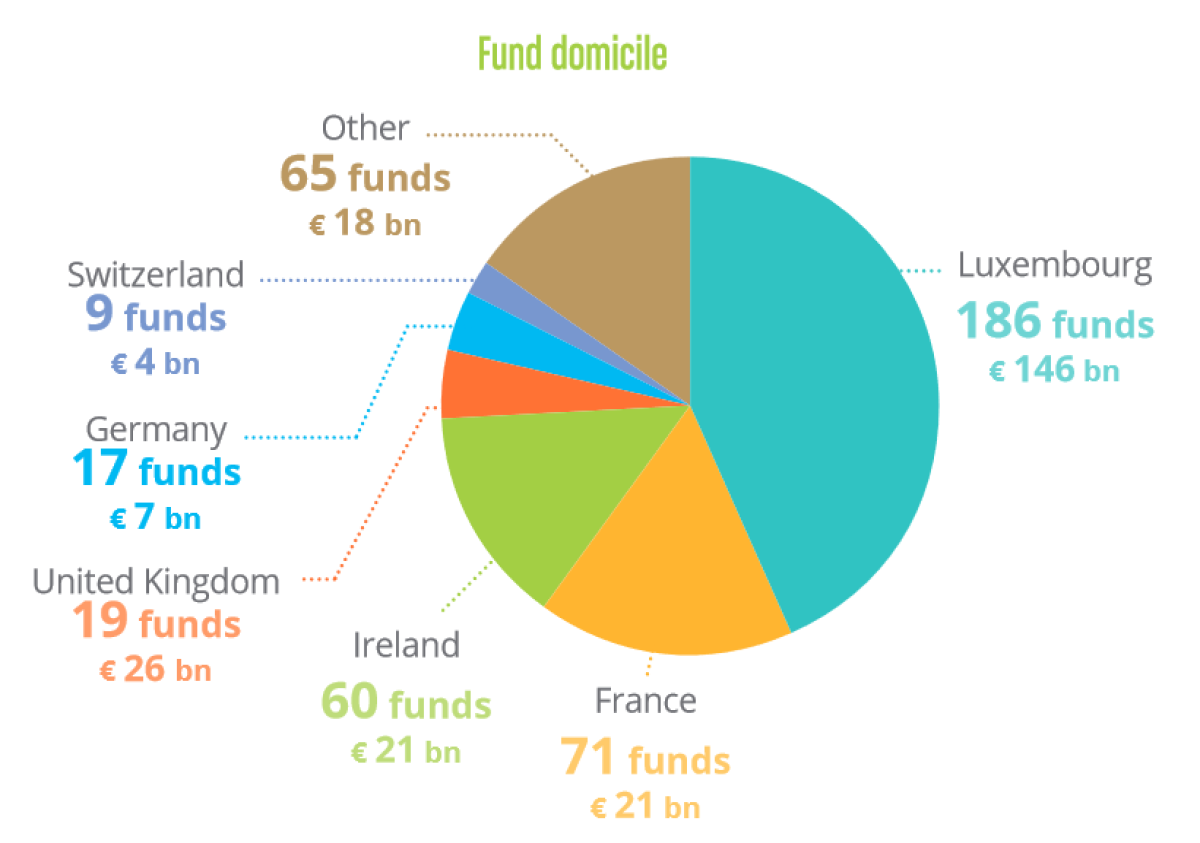

Image Source: cleanenergywire.org

In addition to setting goals, creating a budget plan, and being mindful of your spending habits, mastering budgets also involves regularly reviewing and adjusting your budget as needed. Life is constantly changing, and so are your financial circumstances. By regularly reviewing your budget and making adjustments when necessary, you can ensure that your financial goals remain achievable and that you stay on track towards financial success.

Budgeting like a pro is not just about restricting your spending or living frugally – it’s about taking control of your finances and making conscious decisions that align with your goals and values. By mastering budgets, you can pave the way to sustainable financial growth and create a solid foundation for a secure financial future.

So, whether you’re just starting out on your budgeting journey or looking to take your financial management skills to the next level, remember that budgeting like a pro is the key to unlocking your path to financial success. By setting clear goals, creating a detailed budget plan, being mindful of your spending habits, and regularly reviewing and adjusting your budget, you can take control of your finances and achieve your financial goals with confidence and ease.

Unleash Your Potential with Masterful Budgeting Techniques

Budgeting is often seen as a tedious task, filled with restrictions and limitations. However, when done correctly, mastering budgets can actually unlock a world of potential and lead to sustainable financial growth. By implementing masterful budgeting techniques, you can take control of your finances, set and achieve your goals, and pave the way for a brighter financial future.

One of the key components of mastering budgets is creating a detailed and realistic budget plan. This involves tracking your income and expenses, identifying areas where you can cut back or save money, and setting achievable financial goals. By having a clear understanding of your financial situation, you can make informed decisions about where to allocate your money and prioritize your spending.

Another important aspect of mastering budgets is staying disciplined and sticking to your budget plan. This means avoiding impulse purchases, sticking to your budgeted amounts for each category, and regularly reviewing and adjusting your budget as needed. By staying disciplined, you can avoid falling into debt, build up your savings, and work towards your long-term financial goals.

In addition to creating a budget plan and staying disciplined, mastering budgets also involves finding creative ways to increase your income and decrease your expenses. This can include negotiating lower bills, finding ways to save on everyday expenses, and exploring new income-generating opportunities. By being proactive and resourceful, you can maximize your financial resources and make the most of your budget.

Furthermore, mastering budgets also involves setting specific and measurable financial goals. Whether it’s saving for a vacation, paying off debt, or investing in your future, having clear goals can help motivate you to stick to your budget and make smart financial decisions. By setting goals, you can track your progress, celebrate your achievements, and stay focused on the bigger picture.

Another key aspect of mastering budgets is embracing the concept of mindful spending. This means being intentional and thoughtful about where you choose to spend your money, and making conscious decisions that align with your values and priorities. By practicing mindful spending, you can avoid unnecessary expenses, reduce waste, and ensure that your money is being used in a way that truly matters to you.

In addition to these techniques, mastering budgets also involves cultivating a positive mindset towards money and financial management. Instead of viewing budgeting as a chore or a burden, see it as a tool that can empower you to take control of your finances and achieve your goals. By adopting a positive attitude towards budgeting, you can approach it with enthusiasm and creativity, and ultimately set yourself up for financial success.

In conclusion, mastering budgets is a key to sustainable financial growth. By implementing masterful budgeting techniques, you can take control of your finances, set and achieve your goals, and pave the way for a brighter financial future. By creating a detailed budget plan, staying disciplined, finding creative ways to increase income and decrease expenses, setting specific goals, practicing mindful spending, and cultivating a positive mindset, you can unleash your potential and achieve financial success. So, don’t wait any longer – start mastering your budgets today and watch your financial dreams become a reality.

Financial Acumen: Managing Budgets for Sustainable Growth